In order to meet user needs as a business, we must have relevant consumer insights. 💡

The situation is usually more challenging for global companies that operate in the China market, where businesses of all kinds are becoming more digitally savvy. In addition, Chinese consumers are increasingly active on the social media ecosystem, including WeChat, Douyin, and Little Red Book, among others.

In this blog, we’ll discuss how brands can analyze their peer group’s social media data to find out what consumers think. As an example of how global airline brands gather relevant consumer insights in China, we hope to inspire you to do the same.

p.s. If Chinese social media platforms seem strange and unfamiliar to you, you are not alone. And we’ve got you covered. 👉 Read More.

Brands can derive consumer insights from all the data they collect on their customers across various touch points by interpreting and analyzing it. Generally, some are more expensive than others: some are directly obtained, such as feedback from customer interviews and form fills ; others can be derived from website analytics … Businesses in China, however, place a greater emphasis on social media analytics.

Relevant Consumer Insights

Global businesses operating in the China market often invest in their consumer insights, despite the cost, as it eliminates guesswork in decision-making.

However, at KAWO, we’ve noticed that consumer insights managers in a variety of industries, such as the hospitality industry, draw consumer insights from benchmarking competitors’ social media performance data as a fast and cost-effective way to gain relevant insights into the needs and trends of their target customers.

A few ways brands gain consumer insights that are timely and relevant from KAWO:

- Exploring the keywords and content that are trending in your peer group to learn what your competitors’ customers are interested in or not

- Discovering your competitors’ best social media practices to learn from

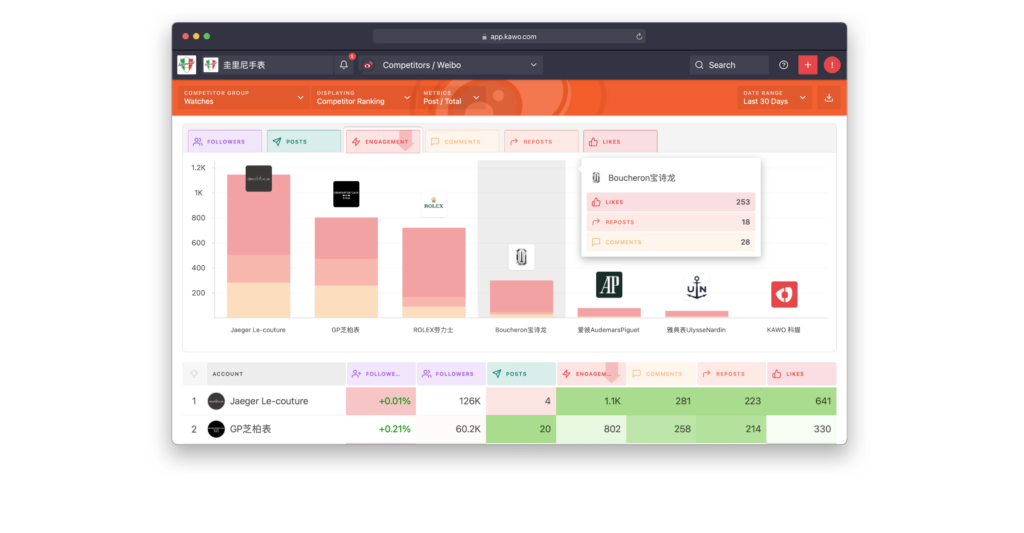

- Identifying your position in relation to industry averages and mediums of social media metrics, such as Follower Growth, Engagement, and Reach

Which Airline Drives the Best Engagement on WeChat?

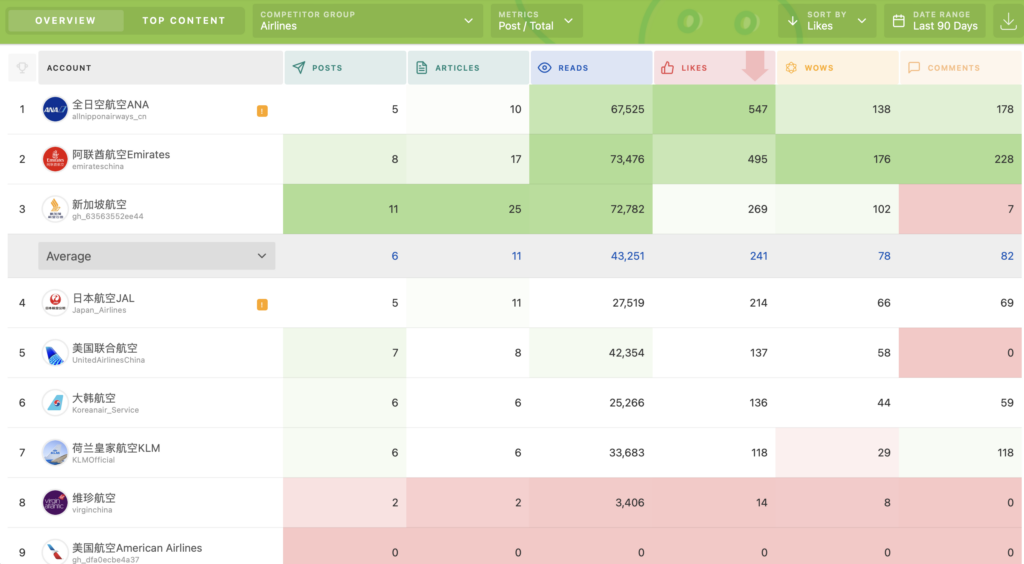

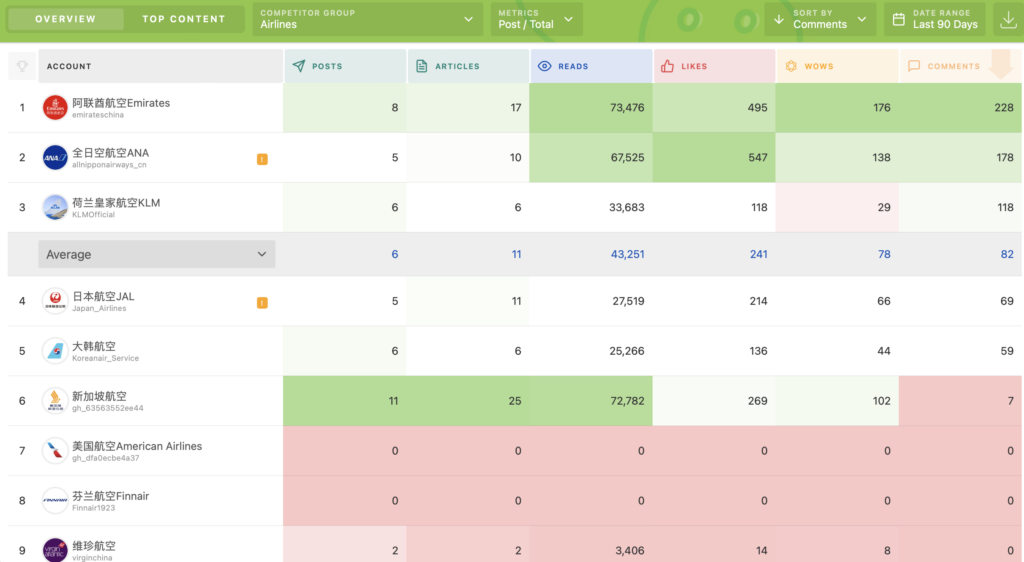

Imagine we are an airline brand. Let’s take 10 global airlines as an example, Singapore Airlines, Emirates, Japanese Airlines (JAL), All Nippon Airways (ANA), Korean Air, American Airlines (AA), Virgin Atlantic, Finnair, KLM Royal Dutch Airlines, and United Airlines (UA), and look at their Chinese social media presence during the last 90 days (Q2 2023).

We observe some facts, but before we go there, let’s look at 3 metrics used in this example:

ARTICLES: Total number of WeChat articles published in the selected date range

LIKES: Total number of likes received on the post in the selected date range

COMMENTS: The number of comments received on the post in the selected date range

WOWs: The number of wows received on the post in the selected date range

▶️ Step one: Briefly describe the relevant facts

In terms of ARTICLES posted on their WeChat official account, Singapore Airlines made the most effort, followed by Emirates and Japan Airlines. (Q2 2023)

Although they posted fewer articles on their WeChat official account than Emirates or Singapore Airlines, All Nippon Airways (ANA) received the most LIKES (Q2 2023)

It was Emirates that got the most COMMENTS, more than All Nippon Airways (ANA) and KLM Royal Dutch Airlines. (Q2 2023)

▶️ Step two: Following the observation, ask questions that help you draw relevant insights

- Some content posted by Singapore Airlines did not seem to draw enough engagement from its followers. What went wrong an how to improve?

- All Nippon Airways (ANA) posted less but some content received good engagement. What were some of the most successful posts to learn from?

- What topics or key words does Emirates post about that made their followers more active than their peers?

▶️ Step three: Analyze and find out the answers to draw relevant consumer insights

🔍 Singapore Airlines

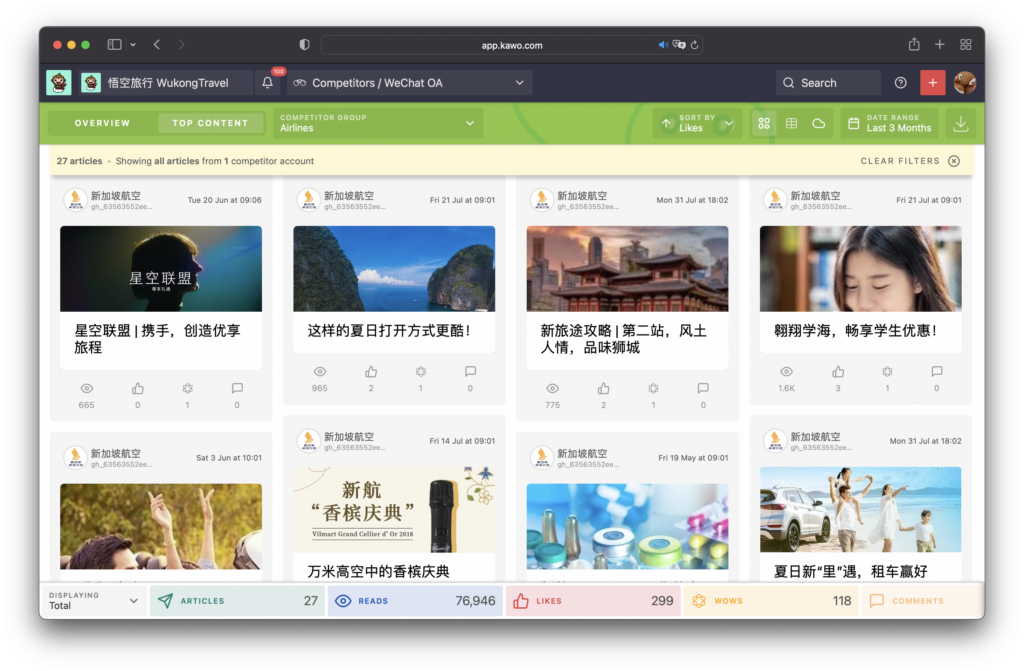

There is a link between READS and the total number of followers an account has, the more subscribers you have, the more reads the account will receive; a comparison of accounts with small followings and those with large followings is unfair. Hence, we chose to analyze another metric: LIKES, as your audience must actively engage with your content in order to demonstrate your quality.

Sorted by LIKES, we found that posts from Singapore Airlines‘ WeChat accounts that didn’t perform well have titles that sound like ads without mentioning the value or feature their target customers would find interesting. 👇

As we move forward, we’ll focus first on the two posts that did well, and then on the one that didn’t drive much LIKES:

- The most liked posts, “Free Wi-Fi for all members, Singapore Airlines has done it! (全员Wi-Fi免费不限时,新航做到了!)” announces that the airline is now providing free Wi-Fi to its members got the most LIKES.

- The second mostly liked post during the selected date range, “World’s Best Airline, Singapore Airlines Won!(全球最佳航空公司,新航拿下了!)” shows the airline’s credibility by sharing the news that it has won Skytrax, the industry’s Oscar.

- While the content provides a lot of good information, the title of the post that gets the fewest LIKES, “This way of opening summer is even cooler! (这样的夏日打开方式更酷!)” is generic and requires no action.

Insight 1: We concluded from analyzing Singapore Airlines‘ WeChat posts that titles affect how much ENGAGEMENT the content can drive, and should provide readers with specific value, as well as enough key information to engage them.

🔍 All Nippon Airways (ANA)

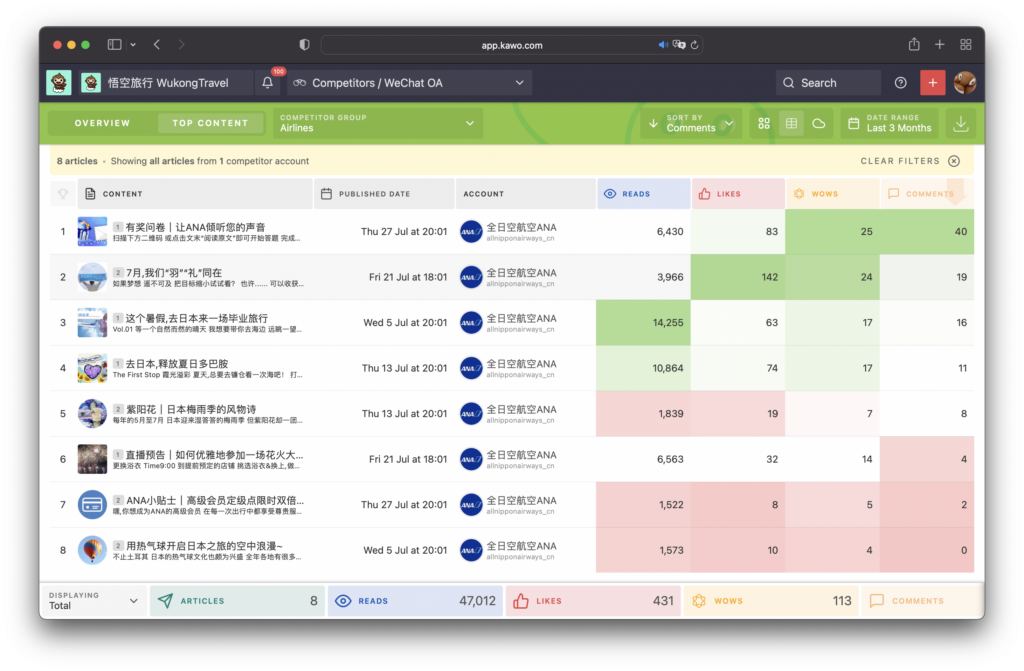

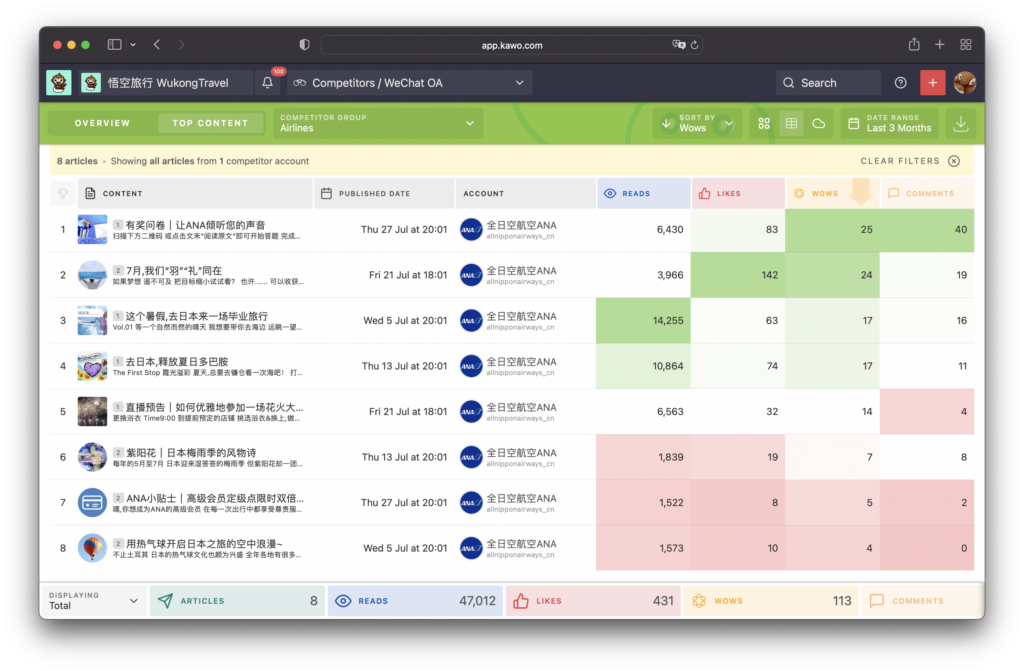

In order to discover which posts on All Nippon Airways (ANA) drive the most engagement, and why, we tried out and ranked all the posts during the selected date range by two (other than LIKES) engagement metrics COMMENTS and WOWs. The results are:

🏅️ Questionnaire with prize | Let ANA hear your voice (有奖问卷|让ANA倾听您的声音)

🥈 Feather and gifts are paired together in July.(7月,我们“羽”“礼”同在)

🥉 Take a graduation trip to Japan this summer (这个暑假,去日本来一场毕业旅行)

After further analysis, we discovered the top content on All Nippon Airways (ANA) were all CTA-driven, offering free value or prizes, to actively encourage engagement from their followers, including feedback, participations, information requests, etc.

Insight 2: As a result of analyzing All Nippon Airways (ANA) WeChat posts, we concluded that CTA-driven posts effectively drive engagement, and if the post provides free value or prizes, its title should indicate the benefit.

🔍 Emirates

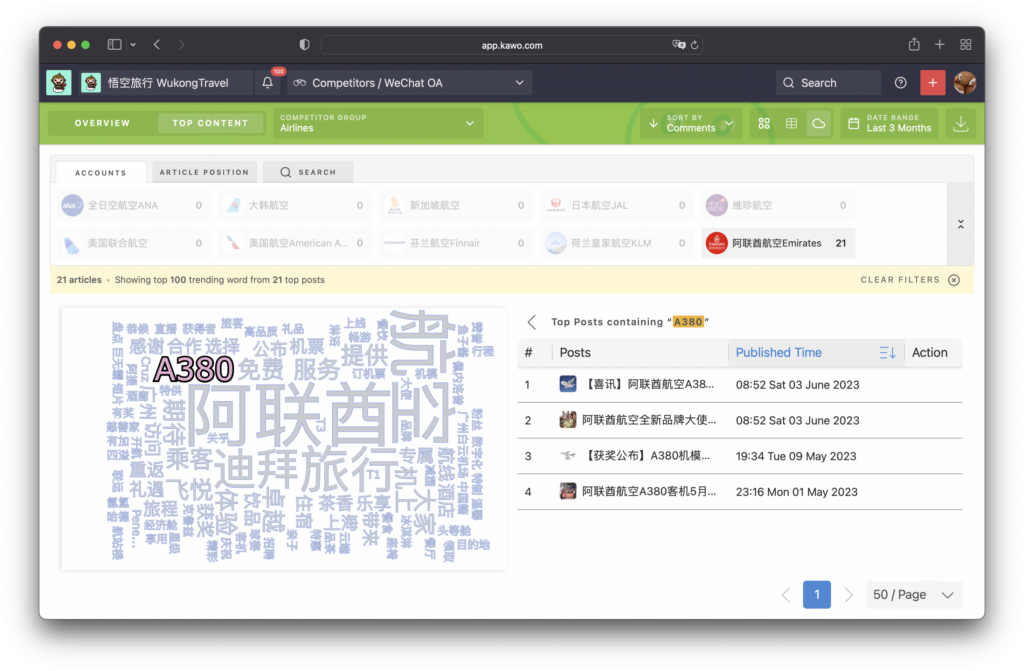

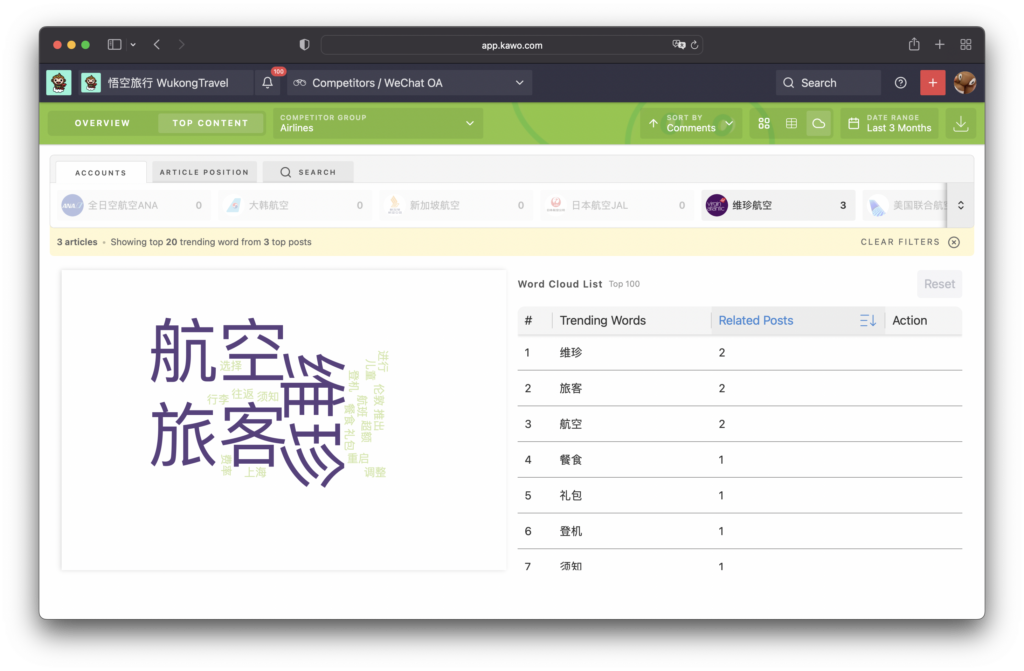

By using the Word Cloud feature, we can identify Emirates‘ key words and dig deeper into individual posts to discover what the company discusses the most frequently.

When comparing the key topics of Emirates and Virgin Atlantic, we also found that consistency and diversity play an important role since the latter does not receive as much engagement.

Insight 3: In our analysis of the 10 global airlines we examined, Emirates appeared to have the largest following number, a private metric exclusive to the airline, and they consistently post content that is of interest to their followers, making them the top airline on WeChat with the most engagement.

Here is an example of how global brands can gain relevant consumer insights by benchmarking their competitors’ social media performance data on WeChat. With KAWO Competitors, you can also keep track of your competitors on Weibo, Douyin, Kuaishou, etc. Schedule a demo to learn about the complete solution we offer.

Also, join us Thursday, Aug 24. to learn about Kuaishou, a short video, Ecommerce-driven app that boasts high conversion rates, and should not be ignored by brands looking to sell to Chinese consumers. Register today