We released the “2022 Ultimate China Social Media Marketing Cheatsheet” for brands and agencies to have a better understanding of China’s social media landscape to optimize brands’ social media strategies. In the sheet, we have provided an overview of the country’s mainstream social media platforms in terms of their monthly active users (MAU), demographics, content formats, paid ad options, among other factors.

We also have collected 6 interesting updates and trends happening with different platforms :

6 Major Updates

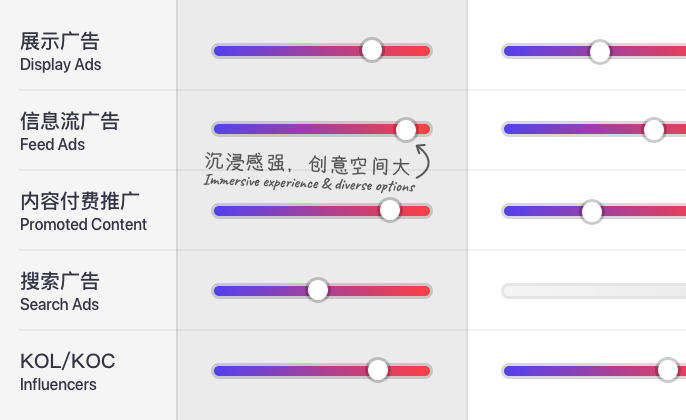

Social has become pay-to-play, so we researched and completely redesigned the way we show paid options for each channel.

Many Bilibili users are entering their 30s, so their consumption demand is expanding. It definitely opens up new opportunities for brands to impress the “cool kids”.

The growth of male users on Xiaohongshu (RED) extends a new exciting playfield for brands to create more gender-neutral content.

Channels has added video ads to its feeds and new e-commerce tools that enable brands to reach a wider audience and sell products and services more efficiently.

Toutiao has merged into Douyin ecosystem which reinforces the dominant position of video content in the social media landscape.

Content-commerce solutions revenue surpassed ad revenue in Q1 can be a new proof of Zhihu’s ambition to attract more brands to promote and build a tighter business bounding with its KOLs.