The spending potential of China’s senior citizens is expected to contribute to a third of China’s GDP in the next 30 years, rising from RMB 5.9 trillion in 2021 to RMB 106 trillion by 2050.

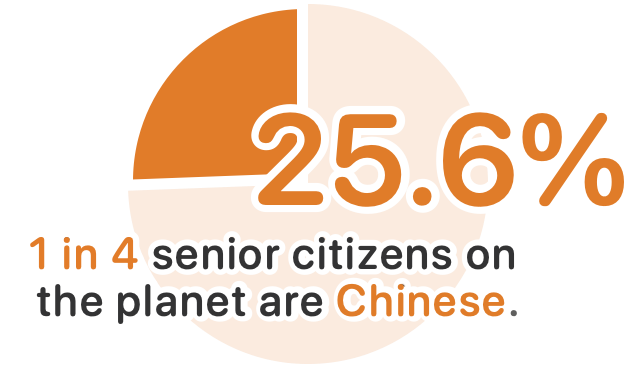

In 2022, China’s population of 60+ year-olds reached 280 million, making up 19.8% of China’s total population. This is swiftly approaching that of the U.S.’s total population of 339 million.

The above number is increasing every year by 20 million to 25 million as the second wave of baby boomers, born between 1962 and 1978, retire — making China the fastest-aging country in the world.

Their willingness to spend grows … especially online

30.8% of China’s 1.07 billion netizens are over 50 years old, and age isn’t slowing them down anytime soon. Online transaction volume made by senior citizens has grown 3 times in the first 8 months of 2022 compared to 2021.

There has been a 12.5% increase in MAU online among seniors and an 8.6% increase in average time spent online compared to 2021, making the 50+ group the fastest-growing consumer group by at least 4 times.

Not only are seniors making more purchases online, but their spending power is highly attractive. The number of seniors with CNY 1000+ online spending power increased by 10.6%, and their willingness to spend was 10.2% higher in 2022 compared to the previous year.

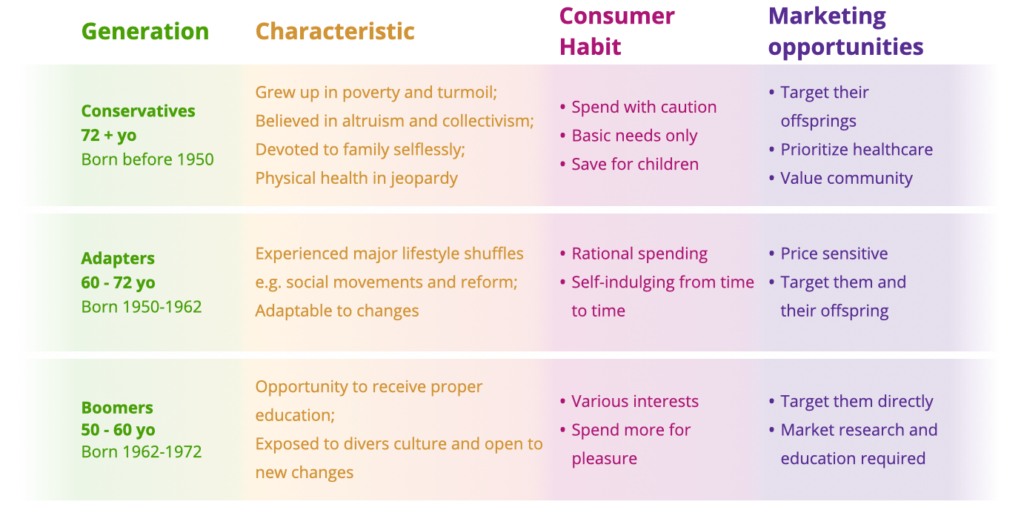

Generation of evolution

Seniors’ mindset is rapidly changing, but the outdated notion that they are reluctant to spend prevails.

Over 90% of entrepreneurs chose to target consumers under the age of 35. The potential consumer demands of senior citizens that could be explored are being ignored.

Seniors potential on social

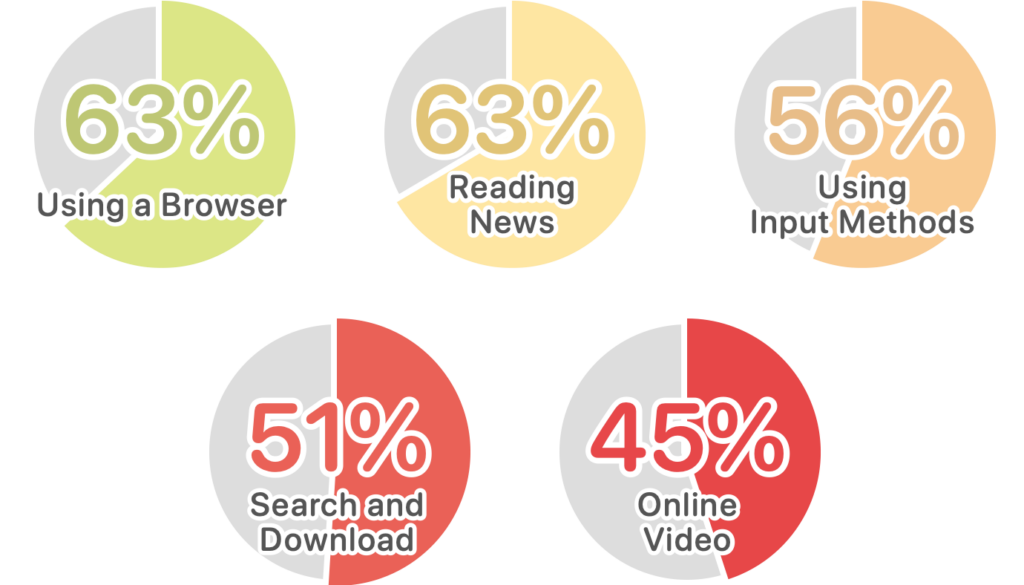

Social media capture most of seniors’ attention online. Mobile usage rate is 99.5% among senior netizens, and most online activities seniors engage in take place on social media apps, including instant messaging, short video and news feed. Here are what Chinese seniors are doing online:

All major China social networks have modified their apps’ interfaces for senior users, including simplifying the design and enlarging font. Douyin rolled out the “Old Friends Program” to optimize user experience for seniors by providing specialized customer service internet addiction and fraud prevention assistance as well as hiring older employees to design better age-friendly content and functions.

The inspiration behind this effort was largely thanks to the growing contribution made to social e-commerce by seniors. During the first half year of 2022, the sales volume of the category ”Senior clothing” on Douyin reached RMB 1.28 billion.

Explore the untapped market

Social media usage and purchasing power of seniors have increased exponentially, yet little effort has been put into studying their needs and behavior changes … This is a missed opportunity for brands across many industries. Read more on KAWO’s Social Media Marketing to Seniors in China 2023 to learn how to explore this market on China social.