So, you’re nosy—totally normal! We’ve all been there, peeking over the fence to see what the neighbors are up to. But when it comes to your brand’s strategy, is stalking the competition really the secret sauce? Well, not exactly. It’s a bit like trying to copy your friend’s answers in class—might work sometimes, but you won’t ace the test.

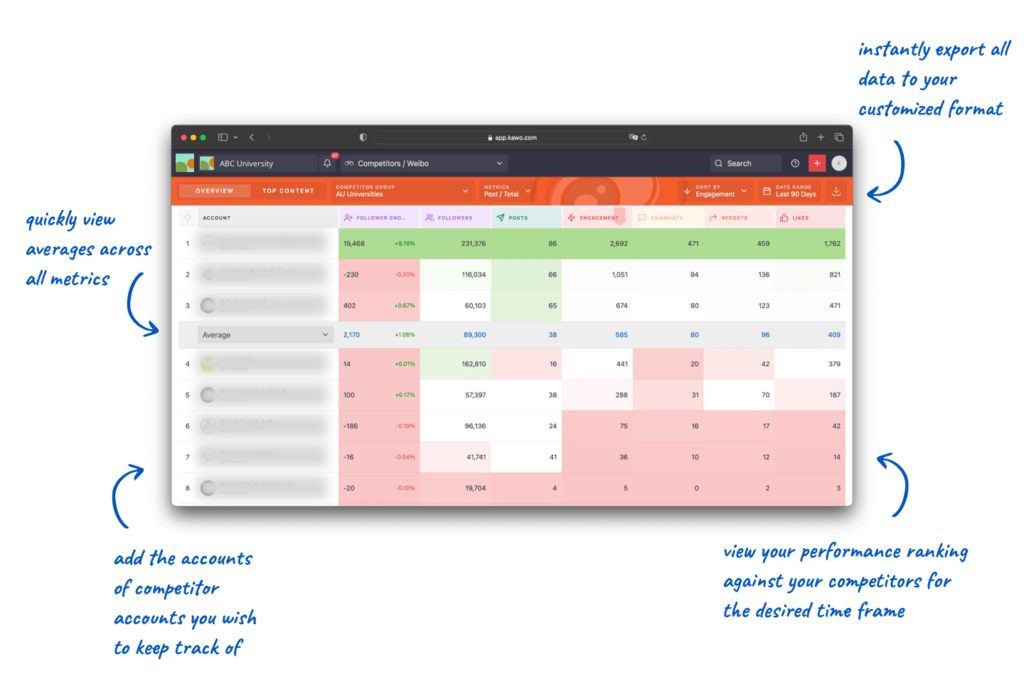

It comes as no surprise to us that the ability to track competitor performance in China has been one of the most requested KAWO features — so, being the customer-centric SaaS company we are, of course, we built it! But, dear friends, it’s how you use it that will make the real difference.

The KAWO Competitor Tracking feature is like the Sherlock Holmes of brand strategy but without the deerstalker hat. So, how can playing detective with your competitors actually help your brand performance in China, without turning into a hot mess? Stick around; we’re about to spill the tea!

First… caution, caution, caution! Having the power to view your competitor’s performance comes with great responsibility. Don’t believe us? Here’s why you must tread carefully…

Where Things Can Go Wrong

A) Divergent Business Goals:

One of the gravest errors in emulating competitors lies in assuming they share the same business goals. Without insight into their Key Performance Indicators (KPIs), blindly copying their strategy may not align with your unique objectives.

Imagine your competitor is a well-established brand that entered the China market 20 years ago. Their business goal may be centered around maintaining market share, as such, their social media strategy might focus on customer retention and brand loyalty — which means they could be investing heavily in activities on WeChat, an optimal channel for nurturing loyal followers. If your business is new to the China market and focused on expanding awareness, your strategy might prioritize customer acquisition and market expansion. The tactics and platforms that align with maintaining market share won’t be as effective for a brand seeking rapid growth in a new market.

B) Overlooking Your Unique Strengths:

By fixating on competitors, there’s a risk of neglecting your brand’s distinctive strengths.

Perhaps one of your brand’s unique strengths is exceptional customer service — which is so important in China! And let’s say that data from your competitors suggests that posting more frequently results in higher engagement, so you shift your resources away from responding to messages and community building, to churning out more content. But now, you risk diluting the strong relationships you’ve built with your existing customer base because you’re too focused on content driving engagement rather than brand-to-customer interactions.

C) The Perils of Constantly Playing Catch-Up:

Relying solely on competitors for inspiration can relegate your brand to a perpetual state of reactivity and a lack of authenticity. For B2C brands targeting Chinese millennials and Gen Z, authenticity is a key driver of brand loyalty. If your brand is constantly mimicking competitors, it may come off as inauthentic to these important consumer groups. Authenticity is built on a genuine connection with your audience, rooted in your brand’s unique values and story — not your competitors. Playing catch-up by replicating others’ strategies may erode this authenticity.

Ok, so now that we’ve made the downfalls of relying too heavily on competitor tracking clear, how should you go about doing it effectively? Here are some guidelines to follow…

How to Best Incorporate Competitor Monitoring into Your Strategy

A) Diversify Your Perspective:

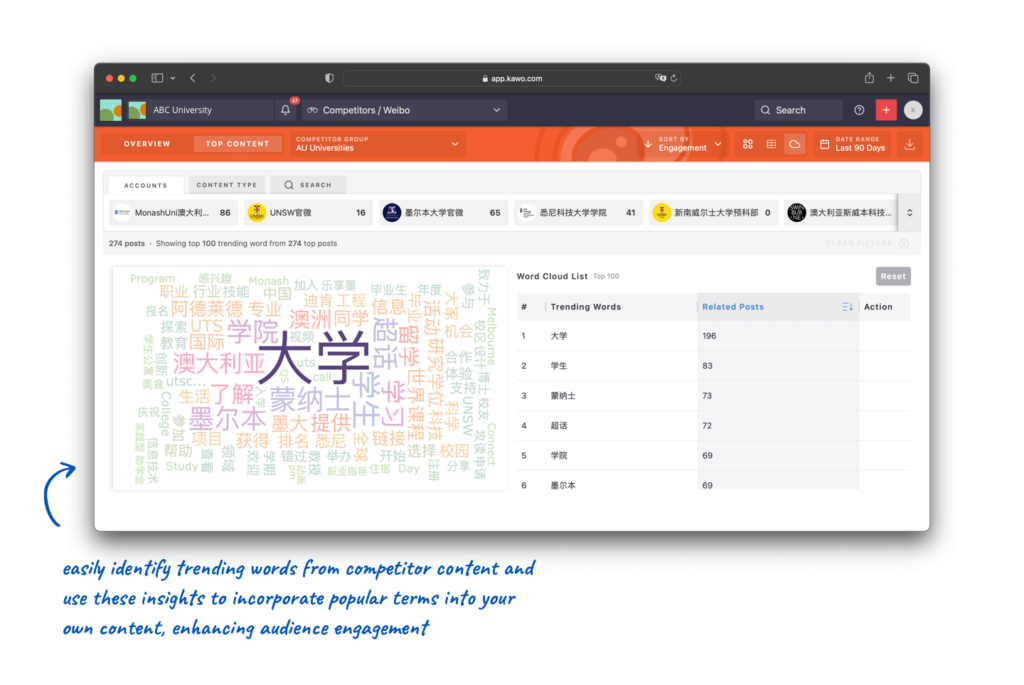

To avoid stifling creativity, look outside your own industry! By examining successful brands from various categories, you can glean insights into diverse content strategies, consumer engagement tactics, and innovative campaign ideas. We’ve done this ourselves at KAWO when we wanted to redesign how we presented our stats to users. Check out our blog on how cartography changed the way we thought about presenting data.

B) Identify Strengths and Weaknesses:

By discerning where competitors excel and fall short, you not only enhance your own strategy but also identify market gaps to exploit.

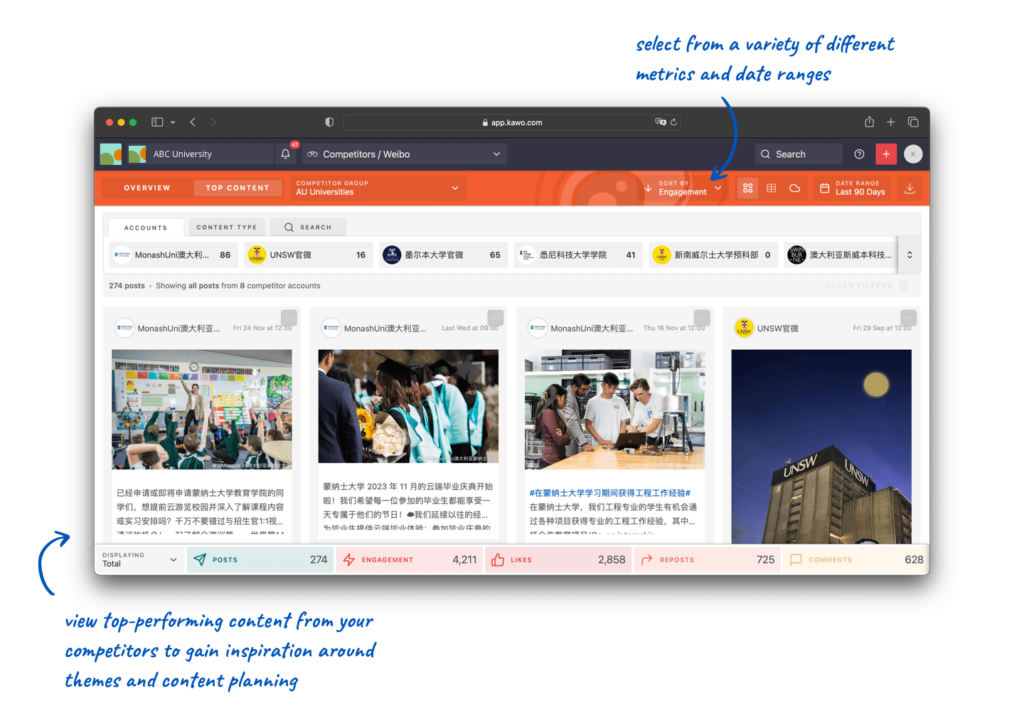

Let’s say you’ve been posting on Weibo for over a year now, but you’re just not getting any traction! So you find that one of your competitors is continuously generating a high level of engagement on Weibo by posting high-quality images at least 3x per week. By recognizing this strength, you can adapt and improve your content strategy to incorporate more visually appealing elements, enhancing the overall effectiveness of your social media presence.

C) Grasp Overall Market Trends:

KAWO’s Competitor Tracking tool isn’t just about individual brands; it extends to monitoring entire categories. This panoramic view enhances your understanding of market trends, empowering you to set more informed KPIs and business goals.

Now that we’ve armed you with the safety guidelines for competitor tracking, you’re ready to rock and roll with KAWO’s Competitor Tracking tool. Remember, the key is moderation—don’t lose sight of your unique business goals. Use competitor tracking for inspiration, not road mapping! Let KAWO simplify the tracking process, freeing up your team to focus on creating the best content for your Chinese fans, instead of spending all their time on data entry. Schedule a demo with KAWO today to revolutionize your approach to competitor tracking and strategy development.

** This may also be helpful — Before you start tracking your competitors, you’ll want to clearly define your brand’s business goals and metrics. Need help setting KPIs for China social media? Check out our latest whitepaper.